2Q 2023 is a good quarter for dividends.

PRIVACY POLICY

Featured blog.

1M50 CPF millionaire in 2021!

Ever since the CPFB introduced a colorful pie chart of our CPF savings a few years ago, I would look forward to mine every year like a teena...

Archives

Pageviews since Dec'09

Recent Comments

ASSI's Guest bloggers

- boon sun (1)

- Elsie (1)

- Elvin H. Liang (1)

- ENZA (3)

- EY (7)

- FunShine (5)

- Invest Apprentice (2)

- Jean (1)

- JK (2)

- Kai Xiang (1)

- Kenji FX (2)

- Klein (2)

- LS (2)

- Matt (3)

- Matthew Seah (18)

- Mike (6)

- Ms. Y (2)

- Raymond Ng (1)

- Ryan (1)

- Serejouir (1)

- skipper (1)

- Solace (13)

- Song StoneCold (2)

- STE (9)

- TheMinimalist (4)

- Vic (1)

Resources & Blogs.

- 5WAVES

- AlpacaInvestments

- Bf Gf Money Blog

- Bully the Bear

- Cheaponana

- Clueless Punter

- Consumer Alerts

- Dividend simpleton

- Financial Freedom

- Forever Financial Freedom

- GH Chua Investments

- Help your own money.

- Ideas on investing in SG.

- Invest Properly Leh

- Investment Moats

- Investopedia

- JK Fund

- MoneySense (MAS)

- Next Insight

- Oddball teen's mind.

- Propwise.sg - Property

- Scg8866t Stockinvesting

- SG Man of Leisure

- SG Young Investment

- Sillyinvestor.

- SimplyJesMe

- Singapore Exchange

- Singapore IPOs

- STE's Investing Journey

- STI - Stocks Info

- T.U.B. Investing

- The Sleepy Devil

- The Tale of Azrael

- TheFinance

- Turtle Investor

- UOB Gold & Silver

- Wealth Buch

- Wealth Journey

- What's behind the numbers?

UOB: Book value, dividend yield & prices to buy at.

Monday, May 1, 2023Posted by AK71 at 9:28 AM 4 comments

Banking crisis spreads! AK issues warning!

Thursday, March 16, 2023

This is a reply to a regular reader and active commentator, Garudadri.

I thought I should publish it as a blog to issue a warning to all readers.

Here goes.

To be quite honest, I am not rubbing my hands in gleeful anticipation of a greater market crash.

Apart from being aware of what a market crash means for many people, I am also a very lazy investor who would very much prefer to do nothing instead of having to do something.

By my own standards, last year was a rather active year for me as an investor, too active for my liking, and I was looking forward to a year of relative inactivity in 2023.

I think Warren Buffett would approve since he famously said that "inactivity strikes us as intelligent behavior."

Nothing would please me more than to see my businesses chugging along nicely and paying me reasonably well, year after year.

I agree with you that if we have the ability to hold long term, barring earth shattering changes to the banking landscape, all three of our local lenders in Singapore should continue to do well even with all the speed bumps along the way.

So, if we have the resources and it is not difficult to find people with deeper pockets than mine, we could buy into DBS, OCBC and UOB now, especially if we don't have any exposure to them yet.

Especially so if we don't plan to look at stock prices regularly over the next few years.

"I would tell investors not to watch the market too closely." - Warren Buffett.

Of course, we have to remember that most of us don't have money gushing in all the time like Warren Buffett does.

He is in a class of his own.

As for the technical analyses (TA) on the stock prices of DBS, OCBC and UOB which I have shared recently in my blog, they are just something I enjoy doing from time to time.

I don't do as much TA as much as I used to many years ago when I was more active in the stock market as a trader.

So, I am probably pretty rusty.

This is why I decided to publish my reply to you as a blog to warn people to take their anti-tetanus jabs before looking at my TA.

AK is just talking to himself as usual.

Warning issued.

16 March 2023. 6 months T-bill cut-off yield lower at 3.65% p.a.

|

| Source: T-bills March strategy. Comments section. |

To read the blog in question and Garudadri's comment, go to:

DBS, OCBC and UOB: Higher or lower? My plan.

Red Alert! Latest content by AK Production House on the spreading banking crisis, exclusively on my YouTube channel:

Ticketing for "Evening with AK and friends 2023" is ongoing.

Posted by AK71 at 3:00 PM 4 comments

Labels:

DBS,

investment,

OCBC,

TA,

UOB

DBS, OCBC and UOB. Higher or lower? My plan.

Wednesday, March 15, 2023

No one can accuse AK of being lazy in the last few days.

I am feeling a little tired from looking at charts and following the news.

Been publishing blogs and producing videos too.

Thinking of taking a few days off from blogging but the OCD in me grabbed me.

For the sake of completeness, one more blog on DBS, OCBC and UOB.

Completeness?

Well, the TA I did yesterday which resulted in two blogs being published paid more attention to the bearish sentiment.

Today, we saw a nice bounce in the stock prices of all three local lenders.

Not to keep readers in suspense, a blog to explore the upside possibility will round things off nicely.

Then, for quite a while, I believe readers can use this blog and the last two blogs as references if they so wish.

So, let's start.

Like I said, the stock prices of all three local lenders had a nice bounce today.

Let us start with the strongest this time, OCBC.

Yesterday, I said OCBC exhibited the most resilience.

Today, the green spinning top delivered and OCBC's stock price broke resistance provided by the 200 days moving average.

That the stock price closed at $12.27 comfortably above the moving average which is at $12.14 is encouraging.

However, whether it will stay above this moving average in the next few sessions remains to be seen.

Volume is the fuel that drives a rally and because OCBC's stock price rose on relatively low volume today, there might not be a strong follow through.

Although a green candle formed today, it has a very long upper wick.

This suggests that Mr. Market lacks conviction as the stock's closing price was a mere 3 cents higher than its opening price while the high of the day was 19 cents higher than the opening price.

If there should be weakness, we would probably see the 200 days moving average, the resistance turned support tested.

If that should break, then, the support levels identified in my previous blog would be next.

Moving on to DBS.

Just like OCBC, DBS saw much lower volume today compared to yesterday even as its stock price moved higher.

As expected, the 200 days moving average, currently at $33.16, remains the resistance to watch even though it is a green candle day.

The MFI suggests that DBS is just about to move out of oversold territory while the MACD suggests that momentum remains very much negative.

This suggests that buying interest could weaken tomorrow and it would be interesting to see if DBS could recapture the 200 days moving average as support.

If there should be more downside, then, the possibility of a move back to $30 a share which I blogged about yesterday is back in play.

Now, for UOB which I said yesterday had the weakest chart of the three.

Has this changed?

I was pleasantly surprised when I saw the resistance provided by the 200 days moving average taken out but it only lasted for a short period of time.

UOB's stock price eventually retreated to close only 3 cents above its opening price.

The 200 days moving average is, therefore, still the immediate resistance.

Volume today was very much lower than yesterday too.

So, it really isn't surprising that the push to move the stock price much higher could not be sustained.

The green candle formed is similar to OCBC's as it has a very long upper wick which suggests a lack of conviction on Mr. Market's part.

The MFI suggests that UOB is no longer oversold and the MACD shows that momentum is still negative.

So, it is similar to DBS in this respect which suggests that buying interest could weaken tomorrow.

If prices should move lower, then, the longer term support I identified in yesterday's blog could be tested in due course.

What would I do in such an instance?

Before I continue, please keep in mind that this is what I will do given my circumstances.

We have different circumstances and, also, beliefs.

We should have our own plan even if we are presented with the same set of information.

It is clear to me that stock prices of DBS, OCBC and UOB are all trending down.

Some of us might remember the saying: "The trend is our friend."

Also, "Don't fight the trend."

As a retiree with limited resources, I would rather err on the side of caution.

There is also the fact that I already have a significant exposure to all three local lenders.

So, I am in no hurry to add to my investments.

Technical analysis is mostly backward looking but it can give a glimpse of what might happen from time to time.

This is why I always look for divergences between stock prices and the momentum oscillators as divergences are forward looking.

Looking for divergences was also how I was able to tell that OCBC's stock price would be more resilient than DBS and UOBs'.

Remember to have a plan and it should be your own plan.

Related posts:

1. Buying OCBC.

2. More downside or reversal?

For anyone who is interested, ticketing for "Evening with AK and friends 2023" is ongoing.

DBS, OCBC and UOB: More downside or reversal?

Tuesday, March 14, 2023

Long time regular readers of my blogs know that I have been accumulating stocks of DBS, OCBC and UOB.

The last time I did this on a relatively significant scale was in October 2022.

Over a few days, I increased my investments in OCBC by 11% and UOB by 19%.

Then, the local lenders' stock prices rose and I ceased accumulation.

I like to think that I was not suffering from an anchoring effect as I simply refused to pay higher prices to increase my stakes.

I just didn't think I would be getting as much value for money at much higher prices.

I was adding to my investment in OCBC at almost book value and paying a 5% or so premium to UOB's book value in October 2022.

With the stocks selling off, it now seems that I might have a chance to accumulate at those levels again.

This is a realistic expectation as trading volume has expanded significantly as bearish sentiment took hold.

Of course, seasoned traders know that stock prices could simply drift lower on low volume but when there is high volume on down days, it adds fuel to the fire.

In this blog, I will talk to myself about where I think the stock prices of DBS, OCBC and UOB might be heading.

As I do this, I remind myself that technical analysis is about probability and not certainty.

I will start with what I feel is the weakest of the three, UOB.

Of the three banks, UOB is the only one to end the day with a red candle.

UOB's stock price started the day at $28.05 but closed at $27.84.

The bears are strong here and the flat 200 days moving average at $28.47 will probably be the resistance level to watch for now.

The MFI has entered oversold territory which might bring out some bargain hunters but with momentum deep in negative territory, it is unlikely that UOB would break resistance provided by the 200 days moving average.

I see the next significant support at around $26.90.

This is a many times tested support level which was also the resistance level in the month of October last year.

I feel that DBS's stock shares a similar fate to UOB's but it ended the day with a green candle which is a sign that the selling pressure here is better absorbed compared to UOB's case.

DBS opened at $31.70 but closed higher at $32.33.

Similar to UOB, the 200 days moving average at $33.15, previously the support, will now be the resistance to watch.

Just like UOB, DBS is now in oversold territory which could result in some bargain hunting.

We could see the gap filled at $32.70 in such a case but with momentum deep in negative territory, it is unlikely that resistance provided by the 200 days moving average could be overcome.

We could possibly see a retracement to $30.00 or so a share which was the support level seen in the months of June and July last year.

This is if the bearish sentiment continues to dominate.

So, that leaves us with OCBC which has exhibited the most resilience.

Even though the trading volume was much higher than the day before, a green spinning top, a reversal signal formed.

Now, a single candle reversal signal isn't very strong and it could very well fail.

Just like DBS and UOB, OCBC is now trading at below its 200 days moving average.

Unlike UOB's which has flatlined, OCBC's 200 days moving average, currently at $12.14, is still rising although gently.

The positive divergence in OCBC's chart which I mentioned in recent blogs on our local banks' price action is still visible.

If I were to join the the lowest points in July and October last year, we can see that OCBC's uptrend is still intact.

The trendline could provide immediate support which seems to be at $11.80 to $11.90 this week.

If that breaks, then, the uptrend is broken and we could see a retracement to various supports at $11.70, $11.50 and then $11.30.

These price levels have acted as important supports and resistance many times before.

Depending on which side of the fence we are on, the bear can be a friend or a foe.

If we have been doing the right things, the bear is our friend.

UPDATE:

More than 50% of tickets for "Evening with AK and friends 2023" have been sold. As expected, the tickets are selling at a slower pace this time.

Evening with AK and friends 2023. Ticketing.

Related post:

Buy OCBC. DBS and UOB next?

ComfortDelgro: Special dividend! Earnings jump!

Monday, February 27, 2023

In my blog detailing changes made to my investment portfolio in January 2023, I said that I increased my exposure to ComfortDelgro.

In that blog, I said that ComfortDelgro's fundamentals looked to be stabilizing and, technically, it looked like ComfortDelgro's stock price was bottoming too.

If you missed that blog or need a refresher, see:

Changes to portfolio in Jan 23.

ComfortDelgro has just reported an increase of 63% in 2H earnings, year on year.

Operating costs for the full year increased 6.3% while operating profit increased 35.1% which is pretty impressive, given the many challenges ComfortDelgro is facing.

Higher dividend income from ComfortDelgro is going to be pretty impactful as it is still one of my largest investments.

ComfortDelgro has declared a final dividend of 1.76c per share and a special dividend of 2.46c per share.

ComfortDelgro has a huge cash pile and, if they do not have better use for the money, paying more generous dividends to shareholders cannot be a bad idea.

Technically, ComfortDelgro is now testing immediate resistance at $1.20 which is provided by a declining 50 days moving average.

If this resistance should be broken, there is a chance that the declining 200 days exponential moving average which is currently at $1.30 could be tested next.

There are multiple resistance levels and although analysts covering ComfortDelgro seem to believe that the worst is over with most having mouth watering target prices for ComfortDelgro's common stock, it could take quite a while before we see those levels.

That is from a technical analysis perspective, of course.

Fundamentally, ComfortDelgro should see a gradual improvement in earnings as we continue to see a return to pre COVID-19 pandemic norms.

So, from this perspective, to expect a mean reversion to happen sometime in the future isn't unreasonable.

Still, we want to stay grounded in our expectations.

If we are investing for growth, at this point, it seems that ComfortDelgro is probably a poor choice but as an investment for income, ComfortDelgro is probably still able to pull its own weight in any investment portfolio.

I am not going to hold my breath if I am looking for massive capital gains here, for sure.

Instead, I will celebrate the higher than expected dividend for now.

Reference:

Add CDG or the banks?

Posted by AK71 at 8:01 AM 1 comments

Labels:

ComfortDelgro,

investment,

TA

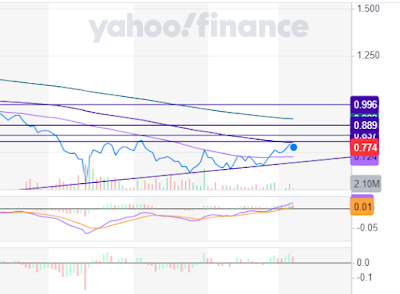

OCBC and IREIT Global: Missed the boat?

Saturday, February 4, 2023

|

| OCBC's chart. |

|

| IREIT Global's chart. |

1. Bankruptcies & property auctions...

Posted by AK71 at 4:10 PM 6 comments

Hang Seng tech ETF: BUY or SELL?

Friday, November 11, 2022

When I bought some Lion-OCBC Hang Seng Tech ETF, many readers were surprised.

AK the IT dinosaur buys Chinese tech stocks?

Alamak!

Growing senile liao lah!

Well, for those who don't know, read:

Trading Chinese tech stocks for pocket money.

Yes, AK isn't really investing in Chinese tech stocks.

AK is trading Chinese tech stocks.

OK, to be honest, there is also an investing element because I only got interested in Chinese tech stocks after their share prices fell from the sky.

Basically, in recent months, Chinese tech stocks have been trading at valuations which value investors might find interesting.

They were trading at what I thought were crazy high valuations before and proponents were all saying high PE ratios were reasonable for these tech companies.

As it turned out, those crazy high PE ratios were only possible because interest rate was zero or even negative.

Then, there were some meme stocks which rode on speculative fervor and tech stocks which didn't even have a PE ratio because they didn't have any earnings!

Still, since the Lion-OCBC Hang Seng Tech ETF does not pay a dividend, as an investor for income, I have to trade it to generate some income.

One of the things I like to remind myself when it comes to trading stocks is to go for stocks which I do not mind holding on to.

Usually, the reason is because I feel these stocks are mispriced and there is a good chance of prices going higher later.

Of course, how much later I don't know.

If you think this sounds like speculation, it is!

What?

You think speculation is bad?

AK hides his face in shame...

As usual, I would keep my speculative positions small or very small.

So, in the event that we have to hold on to our positions, we won't lose sleep over the matter.

In trading, whenever we can book a gain and take some money off the table, we should do so and I have sold what I purchased at 49 cents a unit in late October at 60 cents a unit today.

The declining 50 days moving average is just a bit above 60 cents and should be immediate resistance.

If this should be cleared, then, the declining 100 days moving average is next and it is now at 69 cents but it could be at 67 cents by end of the month.

Yes, the trend is still down and trading to make some pocket money reduces the cost of holding.

It is just like investing in dividend paying stocks but it isn't passive income in this case.

I treat this as an adventure or an experiment.

With a tiny position, it is not something that is going to make me rich.

If it goes bust, it won't sink me either.

If you like what I am doing and would like to do the same, please be mindful of all the things I have said.

Be pragmatic.

Have to stay nimble.

The bear is still very much in control.

Recently published:

IREIT Global: Update.

Related post:

Cut loss on Alibaba or buy more?

Posted by AK71 at 10:18 AM 6 comments

Labels:

China,

investment,

TA

Daiwa House Logistics Trust: FX and TA.

Tuesday, October 25, 2022

The unit price of Daiwa House Logistics Trust has declined 32c or almost 40% in the last 6 months.

This is pretty dramatic.

Although I was unimpressed by Daiwa House Logistics Trust at its IPO and had some concerns, I did not expect its unit price to crash so hard.

At the end of June this year, when a reader asked if I was interested in Daiwa House Logistics Trust as its unit price had declined, I raised a new concern which was the persistent weakness in the Japanese Yen.

Unlike the ECB which is raising interest rate, the Japanese central bank seems determined to keep interest rate low which is depressing the value of the Japanese Yen.

In reply to the reader who asked if the lower unit price made Daiwa House Logistics Trust a BUY back in July, I said that if the Yen was stronger, then, the REIT would be undervalued.

Unfortunately, it wasn't.

I said:

"Since the Yen declined so much, then, a similar decline in unit price doesn't make it (i.e. the REIT) undervalued."

More recently, just a few days ago, the Yen hit a historic low against the U.S. Dollar.

With this recent development, Daiwa House Logistics Trust's unit price has sunk even lower.

I said in my last blog that China was getting very hard to read.

Japan isn't much easier either.

Why is the Japanese central bank so stubborn?

All investments are good investment at the right price.

Unfortunately, at the moment, I do not know if it is the right price but as long as the Japanese central bank is bent on their current course, Mr. Market doesn't know either.

I do not see any positive divergence in the chart as MACD and RSI decline in tandem with the unit price.

I don't have an interest in Daiwa House Logistics Trust.

Just a quick blog sharing my response to a query from someone I know.

Daiwa House Logistics Trust was priced too dearly at IPO and we now have a persistently weakening Yen thrown into the mix.

On hindsight, it might have been a blessing in disguise that Saizen REIT, Croesus Retail Trust and Accordia Golf Trust were forcibly removed from my portfolio.

Recently published:

CLCT: Staying defensive and Chinese banks?

Reference:

Daiwa House Logistics Trust: Good or not?

Posted by AK71 at 12:06 PM 0 comments

Labels:

Accordia Golf Trust,

Croesus Retail Trust,

Daiwa House Logistics Trust,

Europe,

FA,

japan,

Saizen REIT,

TA

Trading Chinese tech stocks for pocket money.

Tuesday, June 7, 2022

I got into Chinese tech in the middle of April this year.

I had no interest in Chinese tech for the longest time because I thought they were trading at crazy high prices.

There is also the fact that I am an ignoramus when it comes to tech stocks.

Sigh, the truth hurts.

Anyway, I forced myself to finally take an interest in the middle of April as the rapid and drastic multi months decline in Chinese tech stock prices made them looked like stuff which value investors might be interested in.

I was also fortunate because I could easily get exposure to Chinese tech stocks through an ETF listed in Singapore.

Fortunate because if I had to buy in the Hong Kong or U.S. stock exchanges, I probably wouldn't have bothered.

If you don't remember or missed that blog, see:

Investing in Alibaba and Tencent now.

Then, a few days later, after the unit price declined by around 10% from my initial purchase price, I doubled my investment in the ETF.

The plan was to buy again if the low of 15 March 22 should be tested.

The low was not tested and I did not add to my investment.

If you don't remember or missed that blog, see:

Buying more Chinese tech stocks today.

I changed my mind later in May because Nio had a secondary listing in Singapore.

Finally understanding that EVs are no longer a novelty but eventual replacement for ICE vehicles, I decided to get some exposure to Nio.

I bought some of Nio's common stock with an eye to accumulate on further weakness in price, specifically if the lows should be tested.

If you don't remember or missed that blog, see:

However, just before I published the blog, I discovered that Nio would be included in the Hang Seng Tech Index soon.

I decided there and then that it would be much easier to simply add to my investment in the ETF which I did.

My smallish position in the ETF accounts for just under 1% of my portfolio now.

Both of my tiny investments in Nio and Lion OCBC Securities Hang Seng Tech ETF are nicely in the black now.

The plan is to hold on to my investment in Nio because I want to see how high it could go especially if it is the next Tesla.

Anyway, it is a really small investment.

So, a small gamble.

As for the ETF, my average price is under 70 cents a unit and the plan now is to sell some if the unit price goes much higher from here.

As the ETF does not pay any dividends received to unit holders, the only way to make some money here is through capital gains.

It has been a while since I did any trading and these are the possible levels I have identified:

|

| Zoomed in to see prices clearly. |

The longer term moving averages are still declining.

So, I am expecting layers of resistance as unit price tries to go higher.

It looks to me like the Hang Seng Tech ETF has bottomed and we can truly buy the dips now instead of buying the downtrend.

A relatively strong band of support should be at 70 cents to 72 cents a unit.

Related post:

Cut loss on Alibaba or buy more?

Posted by AK71 at 2:40 PM 3 comments

Labels:

China,

investment,

TA

Buying Bitcoin at long term support.

Thursday, May 12, 2022

On 5 May 22, I published a blog on why I was looking to add Bitcoin to my portfolio.

The plan was to have gold, silver and Bitcoin form 4% to 5% of my portfolio as insurance against fiat currencies.

This decision was made after plenty of thinking and research.

Of course, there are plenty of cryptocurrencies available but I am only interested in Bitcoin because of the "Bitcoin is digital gold" line of thought.

I have no interest in the "Buy cryptos to get rich quick" line of thought which has a strong speculative flavor to it.

When something gains traction and greater mainstream acceptance, often, we see variants of it spawning as everyone tries to get a piece of the action.

It is no different in the crypto space and very recently, the crypto space had their version of Blumont/Asiasons crash.

Seeing is believing:

Luna has crashed.

Crash is probably an understatement as this Luna crash puts the craters on the Moon to shame.

Many who placed heavy bets on Luna lost everything.

Terrible.

What about Bitcoin?

Well, it is crashing too but not in such a dramatic fashion.

I only got my little toe in the Bitcoin door a couple of weeks ago.

Why not a foot?

I initiated a very small position because I saw a bear flag in the chart.

The suggestion was that price could go a bit higher and then it could swing lower and I would accumulate only at a lower price.

So, with the price crashing now, when would I be buying more Bitcoin?

Using simple moving averages to throw some light on that matter, the 200 days moving average seems like the one to watch.

|

| Chart dated 12 May 22. |

This 200 days moving average is still rising and approaching US$22,000.

Just quick and dirty technical analysis.

Of course, technical analysis shows where the supports and resistance are but it doesn't tell us if they would be tested.

Will just have to wait and see.

Recently published:

Reallocate as interest rate rises...

Related post:

Gold, silver and Bitcoin.

Posted by AK71 at 7:19 PM 6 comments

Labels:

TA

Wilmar was $7.11 a share and DBS, OCBC and UOB?

Monday, January 18, 2021

This blog is in response to questions by readers, csky and linus.

On Wilmar, DBS, OCBC and UOB:

That price target of $5 for Wilmar which I suggested in November 2019 is outdated as Wilmar's chart pattern was damaged by the price action inflicted by the COVID-19 pandemic.

The chart has morphed since then.

For readers who don't know what we are talking about, see:

Wilmar's chart is showing very strong upward momentum right now.

RSI, a momentum oscillator, shows that Wilmar is overbought right now but it could stay overbought for some time.

This is because there isn't any negative divergence in the MACD which is another momentum oscillator.

As the stock price moves higher, the MACD moves higher and this positive momentum suggests price could go higher.

Compared to this, the charts of the three local banks show negative divergence.

Their higher highs in stock prices have been accompanied by lower highs in the MACD.

Softness in the local banks' stock prices is to be expected.

We could see them retreating to test immediate supports.

However, Wilmar's stock price looks like it could go higher.

How much higher?

I don't really do this anymore but I will stick my neck out this time.

You probably remember this blog from 2017:

Accumulating Wilmar on price weakness.

In that blog post, I noted that when Mr. Market was feeling very bullish about Wilmar's prospects (like now), Wilmar's stock traded at a huge premium to its NAV.

It was a really huge premium.

Today, Wilmar's NAV is significantly higher than it was in 2010.

Based on this observation, it is probably not irrational to think that Wilmar's stock price could go higher than $7.11 we saw so many years ago in January 2010.

Having said this, there is nothing wrong with taking profit.

So, selling some to lock in some gains is probably not a bad idea.

Trading around a core position?

Sounds familiar.

Buy more, sell some or hold?

You decide.

I anyhow talking to myself only hor.

Posted by AK71 at 5:48 PM 14 comments

Investment in SPH is larger now.

Saturday, October 31, 2020

Back in early 2017, I blogged about my decision to substantially reduce my exposure to SPH, an old timer blue chip investment in my portfolio.

However, I still retain till this day my investment in SPH made during the Global Financial Crisis more than 10 years ago.

In early 2017, the decision to reduce my exposure to SPH, selling my later investment in the business, was based on the accelerated disruption of its print media business.

I knew of the disruption and was expecting a gradual decline.

Unfortunately and also shockingly, it happened a lot faster than I thought it would.

Then, more recently, SPH's stock price crashed dramatically due to the crisis caused by the COVID-19 pandemic but failed to recover with the broader market.

It reminds me of a Chinese saying:

病來如山倒.

Unfortunately, SPH's print media business is a shadow of its former self today.

Back in the day when AK and Facebook were still friends, I had discussions with some readers on what SPH would be worth.

If we thought that the media business might be worth nothing one day, then, we could value SPH based only on its property investments.

Back then, some said SPH stood for "Singapore Properties Holdings."

SPH has many property investments and probably the most prominent to many people is its big stake in SPH REIT.

Unfortunately, SPH REIT suffered from disruption as well when the COVID-19 pandemic hit.

SPH is terribly unlucky.

It is reasonable to expect that tourists visiting Singapore will not be returning to the pre COVID-19 numbers anytime soon.

So, although not hit as hard as hospitality, it is a reasonable assumption that SPH REIT's crown jewel of a mall along Orchard Road, The Paragon, will continue to suffer.

Still, since SPH's NAV per share is almost all made up of its property investments today, buying at a big discount to this should give some margin of safety.

Of course, like I said before, if the COVID-19 pandemic stays with us for a longer time, we could see defaults becoming more common.

During the Global Financial Crisis, around the world, we saw massive devaluation of properties, for example, and a downward revaluation of 20% to even 30% was pretty common.

If we were to assume a massive revaluation of SPH's property assets to distressed levels, knocking off 25%, we get about $1.50 NAV per share.

So, I believe that, fundamentally, any price below $1.50 a share should give some margin of safety, all else being equal.

Of course, investors for income should also be interested in SPH's dividends.

SPH slashed dividends drastically to conserve cash because of the COVID-19 pandemic.

Prior to the COVID-19 crisis, SPH recorded an earnings per share (EPS) of 13c.

SPH also paid an 11c dividend per share (DPS).

With these numbers, at $1.35 a share (which was the price on 11 June 20 when I was asked about SPH as an investment by a relative), if the pandemic did not happen, it would be quite a straightforward buy.

Now, as COVID-19 lingers, there is uncertainty over the future of SPH's property investments including its student hostels in the UK.

Mr. Market just doesn't like uncertainty.

Even so, SPH REIT's unit price has recovered from its lows while SPH's stock price has only recently formed a new low.

Now, for a bit of speculation again.

Is it conceivable for SPH to pay, say, an 8.0c DPS when normal times return?

Why do I ask this question?

If an investment in SPH is able to give a dividend yield that is similar to or higher than the distribution yield offered by SPH REIT, I would rather invest in SPH instead of SPH REIT.

Then, any better performance by the media business however unlikely would simply be a bonus.

So, was I thinking of increasing my investment in SPH at $1.35 a share?

The 50 days moving average was still on a steep decline and it was providing a strong resistance.

Too much dust and I could catch a falling knife.

So, I decided to wait.

Give it more time and see what happens.

Related posts:

Posted by AK71 at 9:28 AM 39 comments

Monthly Popular Blog Posts

-

Time flies and it is time for another quarterly update. Before I start on the update proper, I just want to say a few words about Wilmar Int...

-

Stock prices of DBS, OCBC and UOB have been rocketing higher! How do I feel? I have mixed feelings, really. I would like to add to my invest...

-

The latest 6 months T-bill auction saw a cut-off yield of 3.78% p.a. Pretty decent although it dipped slightly from 3.8% p.a. we saw in the...

-

When Sabana REIT's unit holders voted for the internalization of the REIT's manager, some readers asked me what I thought of it. For...

-

I shared a photo of one my favorite ships in World of Warships in a video yesterday. Bismark is a ship I enjoy a lot and I have had many ho...

All time ASSI most popular!

-

A reader pointed me to a thread in HWZ Forum which discussed about my CPF savings being more than $800K. He wanted to clarify certain que...

-

The plan was to blog about this together with my quarterly passive income report (4Q 2018) but I decided to take some time off from Neverwin...

-

Reader says... AK sifu.. Wah next year MA up to 57200... Excited siah.. Can top up again to get tax relief. Can I ask u if the i...

-

It has been a pretty long break since my last blog. I have also been spending a lot less time engaging readers both in my blog and on Face...

-

I thought of not blogging about my 2Q 2020 passive income till a couple of weeks later because Mod 19 of Neverwinter, Avernus, just went liv...